- The bank offers digital and in-person EV loans to meet sustainable mobility goals

On World Environment Day, Punjab National Bank (PNB), India’s leading public sector bank, reinforces its commitment to environmental sustainability by offering 0.05% less interest rate on electric vehicles compared to non-electric vehicle loans.

PNB’s strategic focus on green financing has yielded remarkable results, with the bank sanctioning 5,178 electric vehicle loans during the last financial year, marking a substantial increase compared to FY 2023-24. This growth reflects the bank’s dedication to supporting India’s transition towards cleaner transportation solutions.

The Bank’s key sustainable products include: –

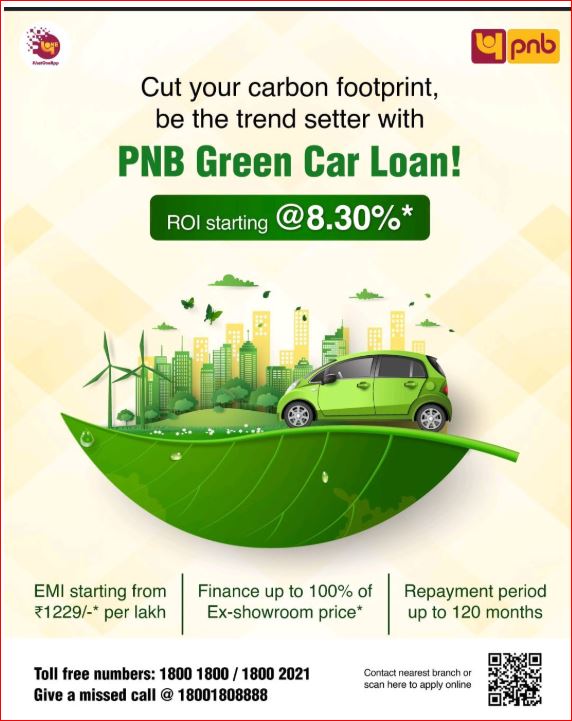

• Electric Vehicle Loans: For financing of Electrical Vehicles, the rate of interest starts from 8.30%. The same can be availed conveniently via Digi Vehicle Loans through “PNB One” app

• Solar Rooftop Financing: PNB’s Solar Rooftop Scheme offers financing of up to 10 kW for solar power systems with nil processing/documentation charges, attractive interest rates starting from 6.50%, and a repayment tenure of up to 120 months.

Speaking on World Environment Day, Shri Firoz Hasnain, CGM-MSME & Retail, PNB said “With over rapid increase in electric vehicle loan sanctions we’re financing a cleaner, sustainable future for generations to come. Our comprehensive green product portfolio exemplifies our belief that banking can be a powerful force for environmental protection.”

Jubilee Post News & Views

Jubilee Post News & Views