Dr. Seema Javed

2022 Pedal to the Metal: IT’S NOT TOO LATE TO ABATE EMISSIONS FROM THE GLOBAL IRON & STEEL SECTOR

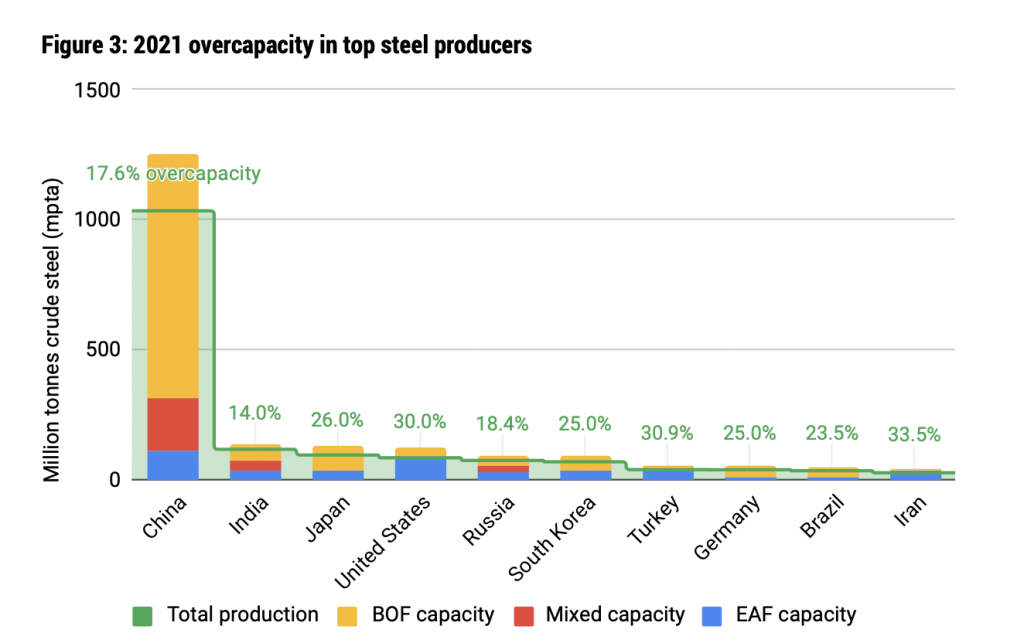

Global Energy Monitor (GEM), tracks global steel and iron decarbonisation efforts, their new report finds that global steel makers are building more blast furnace (BF) based capacity compared to electric arc furnaces (EAF) which are comparatively cleaner and greener.

The report concludes that the global steel and iron industry is not on track to decarbonize as laid out by the IEA’s net zero pathway that requires the share of EAF steel capacity to increase from 31% where it is now to about 37% by 2030 and 53% by 2050.

The steel industry could face USD 518 billion in stranded asset risk as countries work towards meeting their long-term carbon neutrality commitments, if the 345.3 million tonnes per annum (mtpa) of emissions-heavy blast furnace basic oxygen furnace capacity (BF- BOF) proposed or under construction is fully developed, according to new data from Global Energy Monitor’s Global Steel Plant Tracker.

While there is no single “silver bullet” solution for decarbonizing the steel industry, many of the steps that must be taken at iron and steel plants to reduce sector emissions are clear, such as rapidly transitioning from dirier Blast Furnace-Basic Oxygen Furnace (BF-BOF) steelmaking to cleaner Electric Arc Furnace (EAF) steelmaking.

This report serves to provide an assessment of the global iron and steel plant fleet, including capacity that is operating and capacity under development, based on the March 2022 update of the Global Steel Plant Tracker.

Key points:

■

Shift away from BF-BOF capacity is too slow: Current proposals and steel plants under construction put the global shift from BF-BOF to EAF steelmaking capacity dangerously behind decarbonization targets laid out in the IEA’s Net-zero 2050 report. Currently 31% of operating steelmaking capacity uses EAF technology, but only 28% of capacity currently under construction will use EAF technology. By 2030, at least 37% of steelmaking capacity should use EAF technology, and 53% by 2050.

■ Asia is the steel capacity development hotspot: 80% of the BF-BOF steelmaking capacity under development is planned in China (158 mtpa) and India (123 mtpa). An additional 14% is planned in Indonesia (24 mtpa), Vietnam (16 mtpa), and Malaysia (12 mtpa).

■ Stranded asset risk is much higher than previously thought: Stranded asset risk is as much as 518 billion USD, approximately seven times the amount previously thought ($47–70 billion). New pledges to lower national emissions and improved tracking of steel plant projects under development reveal significantly greater stranded asset risk if efforts are not made to cancel or change current steel capacity development plans.

■

Clear standards, definitions, policies needed: The transition from BF-BOF technology to EAF technology will be driven by market demand, policy interventions, and producer incentives for lower emissions steel. In order to create green steel demand and to develop policies and incentives for lower emissions steel production, clear, emissions-based definitions of low-emissions vs. near-zero emissions vs. net-zero emissions are critical.

■ Underreported emissions from coal mining: The full emissions footprint of steelmaking may be drastically greater than reported when coal mine methane emissions are considered. The steel industry currently emits approximately 2.6 Gt direct CO2 emissions and 1.1 Gt indirect CO2 emissions from the power sector and combustion of steel off-gases. Methane emissions from metallurgical coal mining could add an additional 1 Gt CO2-e20 to this footprint, a 27% increase.

Yet progress towards decarbonizing the sector by replacing BF-BOF steelmaking with the less emissions-intensive electric arc furnace (EAF) pathway is stagnant. According to the International Energy Agency’s Net-zero by 2050 scenario, the share of EAF steelmaking

capacity should reach 37% by 2030 and 53% by 2050.

This target requires an additional 576 mtpa EAF capacity while at the same time canceling or retiring 419 mtpa BOF capacity.

According to data in the Global Steel Plant Tracker, the shares of capacity by steelmaking technology would only shift from 69% BOF and 31% EAF in 2022 to 68% BOF and 32% EAF in 2030, and remain approximately the same through to 2050.

The report also finds that emissions estimates for steelmaking fail to account for the impact of metallurgical coal mining. The steel industry currently emits approximately 2.6 gigatonnes of direct CO2 emissions per year and 1.1 Gt of indirect CO2 emissions from the power sector and combustion of steel off-gasses. If the methane emissions from metallurgical coal mining are accounted for in global assessments of steelmaking emissions, the footprint of the steel industry may be as much as 27% (1 Gt CO2-e20) higher than currently reported.

“Transitioning to less carbon-intensive steelmaking is a big part of countries meeting their net zero goals,” said Caitlin Swalec, Project Manager for the Global Steel Plant Tracker. “We need to stop investing in coal-based blast furnace basic oxygen equipment and speed up the shift towards electric arc furnace steelmaking.”

Jubilee Post News & Views

Jubilee Post News & Views