Dr. Seema Javed

Dr. Seema Javed

Since the outbreak of the war between Ukraine and Russia in February this year and following global sanctions on Russia, oil prices have spiralled out of control, leading to record high hikes in fuel prices world over.

International crude oil prices soared to a 14 year high of $140 a barrel on March 7, and some estimates suggest that it could hit $150 a barrel in a scenario of Russian exports coming to a halt.

The basket of crude oil India buys rose above $102 per barrel on March 1. Given that India’s dependence on oil imports from Russia is roughly 1% of its total imports, the on-going war will not impact our supply, but will have serious implications on fuel prices. Already, state owned fuel retailers Indian Oil Corporation (IOC), Bharat Petroleum Corporation Ltd (BPCL), and Hindustan Petroleum Corporation Ltd. (HPCL) are making a loss of Rs 5.7 a litre on petrol and diesel, and to revert to normalised marketing margins, retail prices of these fuels will have to be increased by Rs 9 a litre – that’s a whopping 10%. Domestic fuel prices have not been revised for a record 118 days in a row in the country, and this inevitable rise will have a significant hit on the economy and citizens.

The crude oil market has always been highly volatile, impacted heavily by global and domestic economic and political changes.

For example, in early 2020, the flare up between Iran and the United States drove oil prices to a four month high, leading to an increase in fuel prices. Soon after, domestic factors such as the economic slowdown fueled by the pandemic led to the steepest price rises of Rs 34 per litre for petrol over two years, and Rs 29.5 per litre for diesel.

The message is clear, that India needs to reduce its dependence on imported oil, and subsequently on petrol and diesel. Road transport accounts for 85% of our oil and gas needs – 99.6% of petrol and 70% of diesel is consumed by the transport sector.

Therefore, India stands to gain hugely from electrifying its transport sector. Its benefits extend to ensuring energy security, economic viability against further investment in ICE transport, self-sufficiency in the transport sector, as well as environmental gains such as climate action and reducing air pollution and associated health risks. Further, e-mobility in India is picking up good momentum, with record high sales and demand, aggressive EV policies to support adoption, manufacturing and charging infrastructure. Now would be the best time to press the accelerator on pushing EV penetration across segments – consumer and public transport.

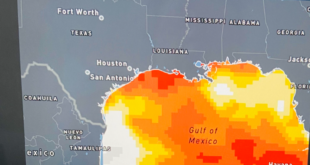

Transport electrification will ensure energy security and economic gains India is the world’s third largest oil consumer, with a demand of 5.5 million barrels per day. Nearly 85% of our oil is imported from about 40 countries, the bulk coming from the Middle East and the US. Crude oil demand is growing at 3 – 4% a year, and India could be consuming about 7 million barrels a day by 2030.

A report by the International Energy Agency highlights that India could become the largest oil consumer by mid 2020s, surpassing China. By the end of this fiscal year, we will spend $110 – 115 billion on oil imports, nearly double the spending of last year. This is not a one-off case of high spending.

In the pre-pandemic fiscal year of 2019-20, we spent $101 billion. Electrification of our transport sector will reduce these oil import costs, lower trade deficits, build self sufficiency, and limit vulnerability to oil supply disruptions and price volatility.

A study by CEEW highlights that if EVs could achieve 30% share of India’s new vehicle sales by 2030, India would save Rs 1 lakh crore ($14 billion) annually on crude oil imports. Further, the increase in electric vehicles penetration could also increase the combined market size of powertrain, battery and public chargers to over INR 2 lakh crore (USD 28 billion), in addition to creating 120,000 new jobs in this sector. EVs can help India’s transport sector become self sufficient Some may argue that lithium and nickel, key minerals used in batteries that power electric vehicles, will also pose similar challenges in future. With 58% of lithium reserves concentrated in Chile, and India having no known lithium reserves, we would be dependent on imports once again – leading to supply and price issues. However, India can become self-reliant in e-mobility by ensuring a circular economy of lithium ion batteries.

According to Himani Jain, Senior Programme Lead, Council on Energy, Environment and Water (CEEW)- “India depends on imports for approximately 85% of its domestic oil consumption, and spends a third of its total import values on crude oil alone. Given the current Ukraine-Russia crisis, global oil prices have become volatile.

According to CEEW analysis, if electric vehicles (EV) occupy a 30% share in new vehicle sales by 2030, India’s oil import bills could reduce by 15 per cent – by around 1.1 lakh crores in 2030 alone. A high public transport modal shift along with fleet electrification can double the savings to 2.2 lakh crore in 2030. Thus, India must focus on reducing vehicle kilometres, shifting to high occupancy modes like buses and increasing EV penetration to reduce its oil import dependence.“

The strategic advantage of lithium is that it can be reused and recycled endlessly, unlike petrol and diesel which burn to nothing. By 2030, India’s lithium-ion battery market size is expected to reach about 800GWh, with EVs accounting for 80% of this need, in line with the government’s ambitious electrification targets.

This provides a huge opportunity to ensure long term sustainability of transportation, by investing in recycling plants. However, this needs robust policies in place at central and state level, as well as tracking, tracing and storing mechanisms. Further, innovations in EV battery manufacturing are also slowly becoming mainstream, to reduce dependence on lithium, cobalt and nickel. ICE vehicles are now a loss-making investment India’s e-mobility ecosystem has significantly strengthened over the last decade.

There are more EV models in the market than ever before, upfront costs of EVs are declining owing to an 89% reduction in lithium ion battery costs, at least 15 states have announced aggressive EV policies that offer lucrative financial incentives for consumers and manufacturers, and a steady increase in charging infrastructure.

● Electric two wheelers have nearly achieved up-front cost parity with ICE two wheelers with the support of national and state level subsidies. Our analysis shows that over a 3 year period, the total cost of ownership of an e-two wheeler would be roughly 30 – 50% less than an ICE two wheeler. Given this, ICE two wheelers are a loss making investment. As the largest two-wheeler market in the world, a 100% electrification in this segment would be a landmark milestone in India’s e-mobility journey.

● Electric four wheelers, despite having a higher up-front cost, are more economical in the long run owing to rising fuel prices. A comparison between an average ICE and EV four wheeler shows that over an 8 year period, the total cost of ownership of an e-four wheeler is marginally cheaper (5%).

● E-buses have also proven to be more economical than their ICE counterparts. With the support of subsidies, the Total Cost of Ownership of an e-bus is already less than diesel buses, and they offer more stability as fluctuation in fuel price has a marginal impact on TCO. By 2030, India needs around 300,000 new buses to meet the demand of its rapidly increasing population. This is an important economic opportunity to transition to e-buses. In 2019, subsidies were sanctioned for 5,595 e-buses across 64 cities and State Transport Undertakings (STUs) under the FAME II Scheme, marking a major milestone in India’s electric vehicle (EV) transition. These buses will run about 4 billion kilometres during their contract period and are expected to save cumulatively about 1.2 billion litres of fuel over the contract period, which will result in avoidance of 2.6 million tonnes of CO2 emission.

● India’s charging infrastructure has grown significantly over the last five years. Several private players such as Tata Power, Magenta, Charge+Zone, Okaya, as well as oil marketing companies like BPCL and HPCL have invested in charging stations. India has nearly 4,000 slow and fast charging stations already in major cities and national and state highways. Under the FAME II scheme, Rs 1,000 Crore have been allocated to support charging infrastructure, and more than 4,400 have already been sanctioned. Oil companies have announced the setting up of 22,000 charging stations across the country, and several states have announced initiatives to enhance charging infrastructure. Other co-benefits of transport electrification Significantly reduce air pollution An analysis by the International Council on Clean Transportation has calculated that if by 2050, 98% of total new vehicle sales and production was to be Electric Vehicles and medium to heavy trucks are 100% EVs, it could reduce tailpipe emissions between 18 – 50% by 2040. Even under the pessimistic scenario in which electricity for EVs is coming from coal and gas, electrification would still lead to a net emission reduction in nitrogen oxides and CO2 , with a marginal to no increase in PM2.5. A subsequent analysis to assess the health benefits of large scale vehicle electrification reveals that this alone will lead to at least 16,700 annual avoided premature deaths in 2040, without considering the decarbonisation of the power sector. Value of Statistical Life calculations show these benefits in avoided health costs amount to $19.1 billion in 2040. By 2030, a 30% EV penetration alone would bring down PM and NOx emissions by 17%, co2 emissions by 18% and GHG emissions by 4%. meeting the 30 per cent EV penetration target in 2030 could lead to several environmental benefits including a 17 per cent decrease each in primary particulate matter and nitrogen oxide and dioxide (NOx) emissions, 18 per cent reduction in carbon monoxide emissions, and a 4 per cent reduction in greenhouse gas emissions relative to the business as usual scenario (BAU), contribute to climate action At COP26 in 2021, India committed to a net zero goal by 2070, and defined a five-pronged strategy to make significant progress in this decade.

By 2030, India aims to raise its non-fossil fuel based energy capacity to 500 GW, meet 50% of its energy requirements from REs, reduce projected carbon emissions by one billion tonnes, reduce carbon intensity by to less than 45%. With the transport sector contributing 13.5% of India’s energy related CO2 emissions, and road transport accounting for 90% of the sector’s energy consumption, India cannot meet its net zero targets without large scale electrification, particularly road and railways.

Nitish Arora, Lead – Electric Mobility and Clean Energy, NRDC says-“The recent spike in oil prices provides a compelling economic case for renewable energy powered EVs over the gasoline powered ICE counterparts. It’s an opportune time for a country like India to remain committed to bold climate reforms and accelerate its effort for turning transport and electricity green to reduce its oil import dependence. Subsequently, it would trigger and drive cost conscious consumers to switch towards EVs more quickly. Balasubramanian Viswanathan, Policy Advisor, International Institute for Sustainable Development (IISD) The oil price crisis is yet another reminder why India needs to decarbonize transport as fast as possible by shifting to electric vehicles. Government support for EVs has increased 4 times over the last three years, at INR 1411 crore in 2020, but it remains low compared to ambition – for 30% of all new vehicle sales to be electric by 2030. The government can also do more to ramp up support for manufacturing – including EV parts, batteries and waste management – as well as greening the power system, so that EVs deliver truly clean mobility.”

( Environmentalist & Communicator for Climate Change)

Jubilee Post News & Views

Jubilee Post News & Views