Dr. Seema Javed

Dr. Seema Javed

As India’s steel sector accounts for 12% of the country’s total carbon emissions—around 240 million tonnes of CO2 annually—the rapid expansion of coal-based production is expected to exacerbate emissions in the near term, potentially doubling the sector’s emissions by 2030.

IIndia’s ongoing investments in new coal-based steelmaking, coupled with a young fleet of emissions-intensive blast furnaces that is set to have its operations extended, jeopardize the country’s Net Zero by 2070 target and risk saddling the country with upwards of US$187 billion in stranded assets, finds a new report from Global Energy Monitor.

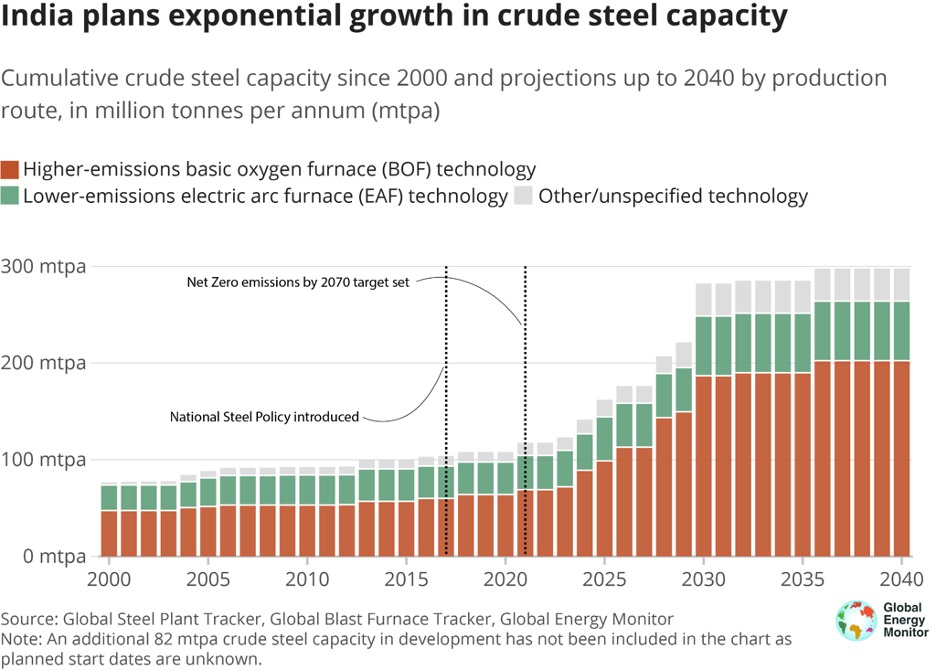

Data in the Global Steel Plant Tracker show that India has the world’s largest pipeline of steelmaking capacity in development, with projects that have been announced or are in the construction phases totalling around 258 million tonnes per annum (mtpa). Emissions-intensive basic oxygen furnaces total over two-thirds of in-development capacity, and less emissions-intensive electric arc furnaces sit at a marginal 13%.

In addition, over 75 mtpa of operating blast furnace capacity was developed in the last two decades, meaning over 43 mtpa is due for relining before 2030. This relatively young fleet of blast furnaces increases the risk of emissions lock-in and poses a challenge to transitioning India’s coal-based steelmaking fleet, as many of these units may still be recovering initial investment costs.

The widespread adoption of coal as the reducing agent in direct reduced iron production is another barrier to cutting emissions in India’s steel sector. Of the direct reduced iron capacity tracked by the Global Steel Plant Tracker, more than half uses coal as the reducing agent and is sourced from domestic high-ash coal, which, while less expensive, comes with a higher emissions intensity.

India already hosts one of the world’s most emissions-intensive steel sectors. Over 87% of India’s operating ironmaking capacity and 90% of capacity in development is dependent on coal. The steel industry in India currently accounts for over 240 million tonnes of CO2 emissions annually, about 12% of the country’s total carbon emissions, and that number is expected to double by 2030.

While India’s short-term solutions to reduce emissions without significant modifications to existing production may lower emissions intensities, India will need to make the grand switch away from coal to fully decarbonize the industry and sustain its production in the long run.

Khadeeja Henna, Heavy Industry researcher at Global Energy Monitor, said, “India’s ‘build now, decarbonize later’ approach to achieving a net-zero steel industry will backfire in the long run. While the 2024 roadmap and action plan for greening the steel sector is a positive step forward, transitioning away from coal-based production is more urgent. Substantial investments are needed to build a robust green steel ecosystem, not betting on emerging decarbonization technologies that have yet to prove their mettle.”

Jubilee Post News & Views

Jubilee Post News & Views